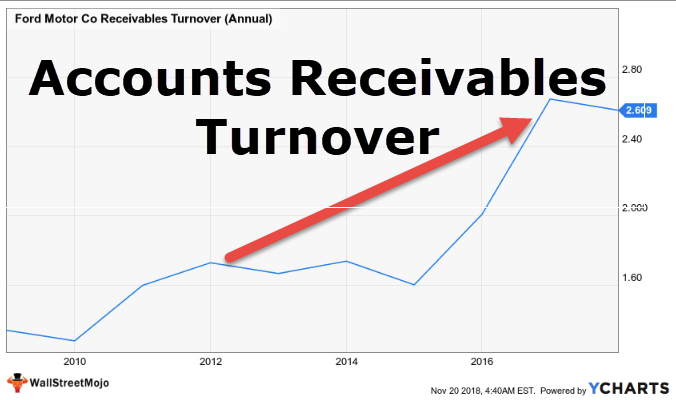

Suppliers can use it to determine the most likely time the company will take to pay them. AnalysisĪs the Accounts Payable Turnover ratio tells how quickly the company pays off its vendors and suppliers, it is usually used by its creditors, vendors, and suppliers to gauge the liquidity of the company. This is again useful for new creditors or suppliers when they are considering extending a credit line to the company and will therefore decide based on the company’s ability to meet this requirement of being able to pay on time and regularly throughout the year. The lower the ratio, the longer the company will take to fulfill its obligations to pay off its suppliers and creditors. See also What is a 10-Column Worksheet in Accounting? (Explanation, and Example) The higher the ratio, the greater the ability of the company to meet its short-term obligations more quickly. It is generally considered best for this ratio to be higher and most favorable for the business. The ratio is interpreted as the ability of the company to pay off its short-term debts and creditors and therefore, the ability of the company to fulfill short-term obligations. This can be interpreted as that during the year, the company took 61.34 days to pay off its suppliers and vendors. This can be interpreted as that during the year, the company paid off its vendors 5.95 times.Īccounts Payable Turnover in Days= 365/5.95 = 61.34 Days

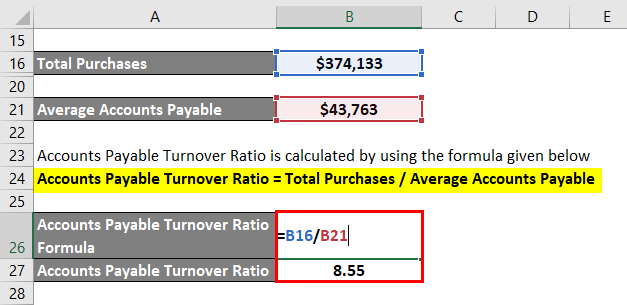

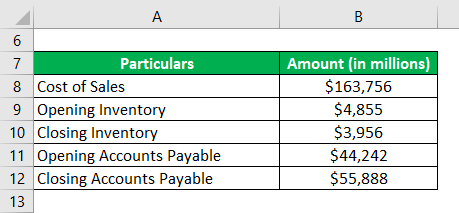

To calculate the Accounts Payable Turnover ratio for the year, the company will use the following formula: The Accounts Payable balance at the beginning of the year was $12,000 and the balance at the end of the year was $25,000. This will give the total ratio in the number of days.Īccounts Payable Turnover in Days = 365 / Accounts Payable Turnover Ratio ExampleĬompany A reports total credit purchases of $120,000 before purchase return of $10,000 for the year ended June 30, 2021. To calculate the Accounts Payable Turnover Ratio in a number of days instead of the ratio form, the ratio itself can be divided by 365. Total Credit Purchases for the Year = Closing Inventory + Credit Purchases – Opening InventoryĪverage Accounts Payable = (Opening Accounts Payable+ Closing Accounts Payable) / 2 Accounts Payable Turnover in Days See also What Type of Jobs Can You Get With an Accounting Degree?Īverage Accounts Payables = (Total Credit Purchases for the Year/ Average Accounts Payables) The Average Accounts Payable will then be calculated by adding opening Accounts Payables to Closing Accounts Payables and dividing them by two to arrive at the average. The total credit purchases for the year can be calculated using the figures from the income statement by using the following formula: adding Closing inventory to total Credit Purchases and then deducting Opening Inventory from this total.Īny purchase returns must be subtracted from this figure. To calculate that, the company must obtain a total of its annual credit purchases divided by the average Accounts Payable for the year. The Accounts Payable Turnover Ratio Formula is calculated by dividing the total purchase by the average Accounts Payable for that period.

The Accounts Payable Turnover Ratio Formula This ratio helps determine the company’s ability to pay off its debts and is often used by creditors to analyze the liquidity of the company so that they can decide whether to extend credit to this company or not. This is done by comparing the total credit purchases of the company over an accounting period to the average Accounts Payable during that time. It measures the ability of the company to pay off its debts by quantifying the rate at which the business pays off its creditors or suppliers, over a given period. The accounts payable turnover formula is a measure of the short-term liquidity of a company. They are a part of the current liabilities section under Liabilities on the balance sheet. Accounts Payables are short-term liabilities that a business owes to its creditors including suppliers and vendors.

0 kommentar(er)

0 kommentar(er)